cryptocurrency app

Cryptocurrency app

Adding security reminders: Cryptocurrency investments carry risks. We want to help our readers stay safe within decentralized ecosystems. However, BeInCrypto is not responsible for any personal financial loss or gain incurred based on our content.< https://netboxclub.com/ /p>

Traditional mining is done individually, on your own time, and according to the work you put in. However, the success of the Pi Network depends on the number of participants. To mine crypto and gain membership levels, you must invite others to join.

Dr. Fan, receiving her PhD in computational anthropology, has also worked as a founding developer of several startups and projects around scaling social communications and surfacing untapped social capital for people everywhere.

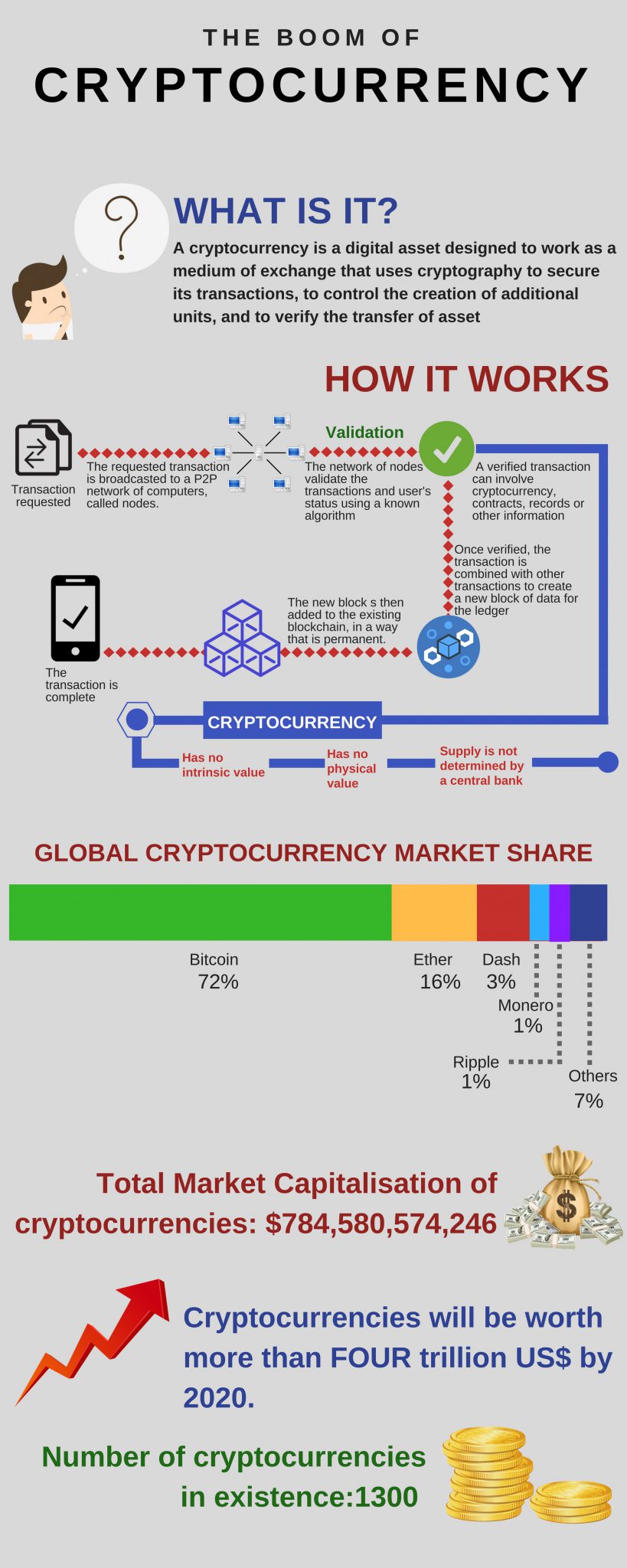

How does cryptocurrency work

Many cryptocurrencies were created to facilitate work done on the blockchain they are built on. For example, Ethereum’s ether was designed to be used as payment for validating transactions and opening blocks. When the blockchain transitioned to proof-of-stake in September 2022, ether (ETH) inherited an additional duty as the blockchain’s staking mechanism. The XRP Ledger Foundation’s XRP is designed for financial institutions to facilitate transfers between different geographies.

Cryptocurrencies use cryptography to encrypt sensitive information, including the private keys – long alphanumeric strings of characters – of crypto holders. Think of private keys as the passwords that determine the ownership of cryptocurrencies. Keep in mind that cryptocurrencies cannot be stored outside of the blockchain. They are permanently based on the blockchain. Hence, when someone says they own X amount of coins, what they really mean is that their password can legitimately claim X amount of coins on the blockchain.

The value of a cryptocurrency usually depends on the utility of its underlying blockchain – though there have been many instances where social media hype and other superficial factors have played a role in pumping up prices.

While blockchain technology is inherently secure, the broader cryptocurrency ecosystem is not immune to risks. Hacks, scams, and fraud have occurred, resulting in financial losses. Users must remain vigilant and adopt best security practices.

What exactly is cryptocurrency? How does it work, and why is it so significant? This comprehensive guide aims to demystify cryptocurrency, providing beginners with a solid foundation in the rapidly evolving cryptocurrency space.

China cryptocurrency

Crypto has an advantage over cash when moving large amounts of value across borders. If, however, these passages are managed using KYC/ AML measures, most transactions would be traceable. CipherTrace analysts found that less than 1% of transactions with crypto are nefarious. Yet, 98% of ransomware uses crypto. The government’s ability to investigate crypto-related crimes is limited in countries where crypto is unregulated.

“A global approach is needed to maximize the advantages from the underlying technology and to manage the risks,” the paper says. “However, given the different stages of market maturity, the development of regional hubs and the varying capacity of regulators, it is prudent to holistically focus also on the important role that international organizations and national/regional regulators as well as industry actors can play in ensuring responsible regulatory evolution.”

At the end of June 2022, the Council presidency and the European Parliament reached a provisional agreement on the markets in crypto assets (MiCA) proposal which covers issuers of unbacked crypto assets, and stablecoins, as well as the trading venues and wallets where crypto assets are held. This regulatory framework is intended to protect investors and preserve financial stability while allowing innovation and fostering the attractiveness of the crypto asset sector. The purpose of MiCA is to provide more clarity across the European Union, as some member states already have varying national legislation for crypto assets, but there had been no specific regulatory framework at an EU level.

According to the Chainalysis Blockchain data platform, more than $50 billion worth of cryptocurrency left East Asian accounts to areas outside the region between 2019 and 2020. As China has an outsized presence in East Asian cryptocurrency exchanges, Chainalysis staff believe that much of this net outflow of cryptocurrency was actually capital flight from China. Although Chainalysis does not have a definitive figure for how much capital fled China between 2019 and 2020, they estimate that it could be as high as $50 billion.

With that in mind, as we release the dark horse of national currency digitilazation, the question of whether it is progress towards a better society for our future generations becomes ever-more pressing.

Innovation in the crypto space is happening rapidly, creating a multiplier effect of new concepts like NFTs and the metaverse. If citizens gain crypto in the metaverse, it could create net wealth. If these proceeds were to be carried outside the metaverse and are substantial, this could have an aggregate demand effect that results in economic growth.